IT analysts unfairly underestimate the potential of the Nordic market. Even though it’s significantly smaller than the US or Asian tech fieldі, the growth is steady and tangible. It has surpassed 50 billion euro and continues to grow at 3.6% annually. The problem is that rapid growth often results in deficiencies. In 2022, the shortage of information and communications technology skills will reach 4% of the total ICT workforce. Even though it might not seem dramatic, it is. Such a shortage will have an enormous impact on startups and tech companies. The resulting loss of revenue and efficiency has already exceeded 7 billion euro.

Under these circumstances, IT outsourcing seems to be a rescue. Especially after the transition to remote work has proven the effectiveness of distant teams. The pandemic has shown that with the right approach, outsourced software development is no worse than in-house. It has opened new opportunities for the Nordic IT region and born strong outsourcing tendencies. In 2021, 27% of Nordic organizations are looking to outsource more. They delegate IT infrastructure, service desks, application development, cybersecurity, and other tasks to third-party vendors.

Are you eager to learn more about Nordic IT outsourcing priorities and trends? Read our overview for valuable insights.

About the Overview

The report relies on authoritative sources providing statistics on the Nordic tech market. It covers Iceland, Norway, Finland, Sweden, and Denmark separately and the Nordic region in general. You will learn what nudges Scandinavian companies to outsource, how the local tech fields look, and more.

Core Business Drivers For Nordics IT Outsourcing

The first thing that inspires Nordic companies to outsource is customer satisfaction. 89% of outsourcers claim they are satisfied with IT service providers, and only 11% express concerns. The overall positive experience makes more and more businesses hire remote tech partners.

Even though many think of cost-efficiency as the primary outsourcing reason, the numbers show it’s not. Speaking of application development and maintenance, most Nordic companies (56%) outsource for specific expertise. Additional flexibility and scalability are almost equally important.

Digital workplace outsourcing is chosen for slightly different reasons. The focus on core business and cost regulation dominate among them. 69% of companies outsourcing digital force report focus on core business processes as their primary driver.

A relatively smaller percentage of respondents prefer service desk outsourcing. Out of them, 44% delegate support tasks to concentrate on their businesses, and 42% aim for better scalability and flexibility.

IT infrastructure outsourcing, first of all, benefits the scalability and flexibility of outsourcers. It’s also a popular way to optimize business operations and expenses.

Generally, the reasons to outsource in the Nordic market are similar to other regions. Companies want to make strategic choices while somebody ensures tech support. They also view IT outsourcing as a way to stay more agile, transform, and cut expenses. Reduced time-to-market is among other significant drivers.

What Do Nordic Countries Outsource

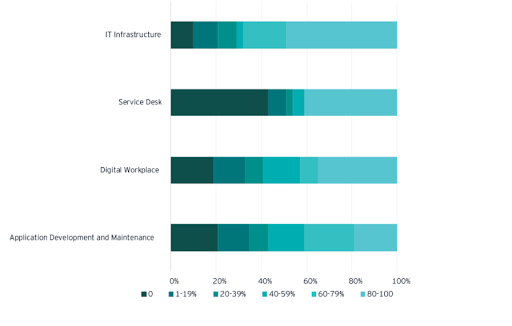

Based on the Nordic IT Sourcing Survey, outsourcing in this region centers around four core domains: IT infrastructure, Digital Workplace, Service Desk, and Application Development & Maintenance. Generally, the share of outsourced services is high across all these fields, with two-thirds of survey participants outsourcing over 60% of their services.

IT Infrastructure is the most popular outsourcing option. Almost half of the respondents outsource 80-100% of their infrastructure. Service desk outsourcing is a less common choice, with two-fifths stating they keep their Service Desk in-house. Application Development and Maintenance is the easiest service to outsource and, therefore, many Nordic companies delegate it fully or partially.

What Keeps Nordic Companies From Outsourcing

Despite the evident benefits of IT outsourcing in the Nordic region, some factors make companies hesitate. Most businesses (58%) fear dependency on external provider(s). They feel like a remote team is unreliable and prefer more control over the software development process. The second-largest risk is loss of knowledge, with 44% of respondents mentioning it. Other fears associated with IT outsourcing among Nordic companies include reduced service quality (44%), internal management issues (39%), lack of agility (36%) and control (33%).

Nordic companies looking for IT outsourcing should take these risks into account to find the best partner. Most of them can be avoided with the right software vendor and proper management.

How Nordics Outsourcing Priorities Have Changed During the Pandemic

In the pre-COVID era, the interest in outsourcing was declining. The Western and Nordic companies were abandoning third-party suppliers. The start of the pandemic turned the wave. Although over the first months, companies were releasing external contractors to stay afloat, quite soon, they changed the strategy. The need to ensure sustainability during lockdowns sped up digital transformation by six years and, therefore, increased the demand for tech expertise.

The Nordic market also witnessed the impact of global outsourcing trends. As a result, insourcing decreased by 5%, sidestepping to remote teams. The research carried out in Denmark shows the increasing need for automation and digitization that will require skilled IT professionals in the upcoming years. Local executives plan to increasingly apply automation across all their business operations, especially procurement (2.0x), risk management (2.3x), research & development (2.7x), and supply chain (1.6x). These tendencies stem from the demand for greater automation and digitalization that has become evident with the pandemic.

General Overview of the Nordic IT Market and Outsourcing

The previous sections covered the outsourcing business drivers and risks across the region. Now, we will talk about the similarities and differences between Nordic countries, such as Sweden, Denmark, Finland, Norway, and Iceland.

IT Market Landscape and Tech Leaders Across Counties

The Nordic region is home to many world-renowned startups like Spotify, Klarna, Rovio, Bambora, and Zendesk. Every county has a strong tech industry and great projects to boast. Let’s talk about each of them in more detail.

Sweden

Sweden is the largest of Nordic countries with the strongest startup ecosystem. It’s home to the highest number of unicorns and scaleup companies, and is one of the most technologically advanced countries in the world.

Behind the success of Swedish startups and the stable growth of the IT industry stands one of the highest investments in research in the world. Sweden invests more than 3 percent of the country’s GDP in R&D. The second favorable aspect is a strong talent pool.

Still, big challenges such as a need for processing and analyzing rapidly growing amounts of data remain, followed by the serious lack of IT skills.

Denmark

Denmark has the second largest startup ecosystem in the Nordic region despite being geographically the smallest country.

In 2018 the Danish government presented Denmark’s ‘Digital Growth Strategy’, which was aimed to secure and enhance the country’s position as a digital frontrunner. To bring the Danish nation into the digital future the government allocated 134 million EUR to initiatives running until 2025, which provided a boost to the Danish tech ecosystem and stimulated the use of advanced technologies. As a result, Denmark was named one of the most digitized economies and societies among the 28 EU member states, according to the European Commission’s 2020 annual ranking.

The Danish startup ecosystem is primarily located in Copenhagen and its surroundings. Its strongest areas are quite diverse and include Fintech, Greentech, Smart City-solutions, Robotics, Healthtech and Life Sciences.

Despite the stable growth of the Danish IT market and government’s incentives, the IT field anticipates a shortage of 22,000 IT graduates by 2030.

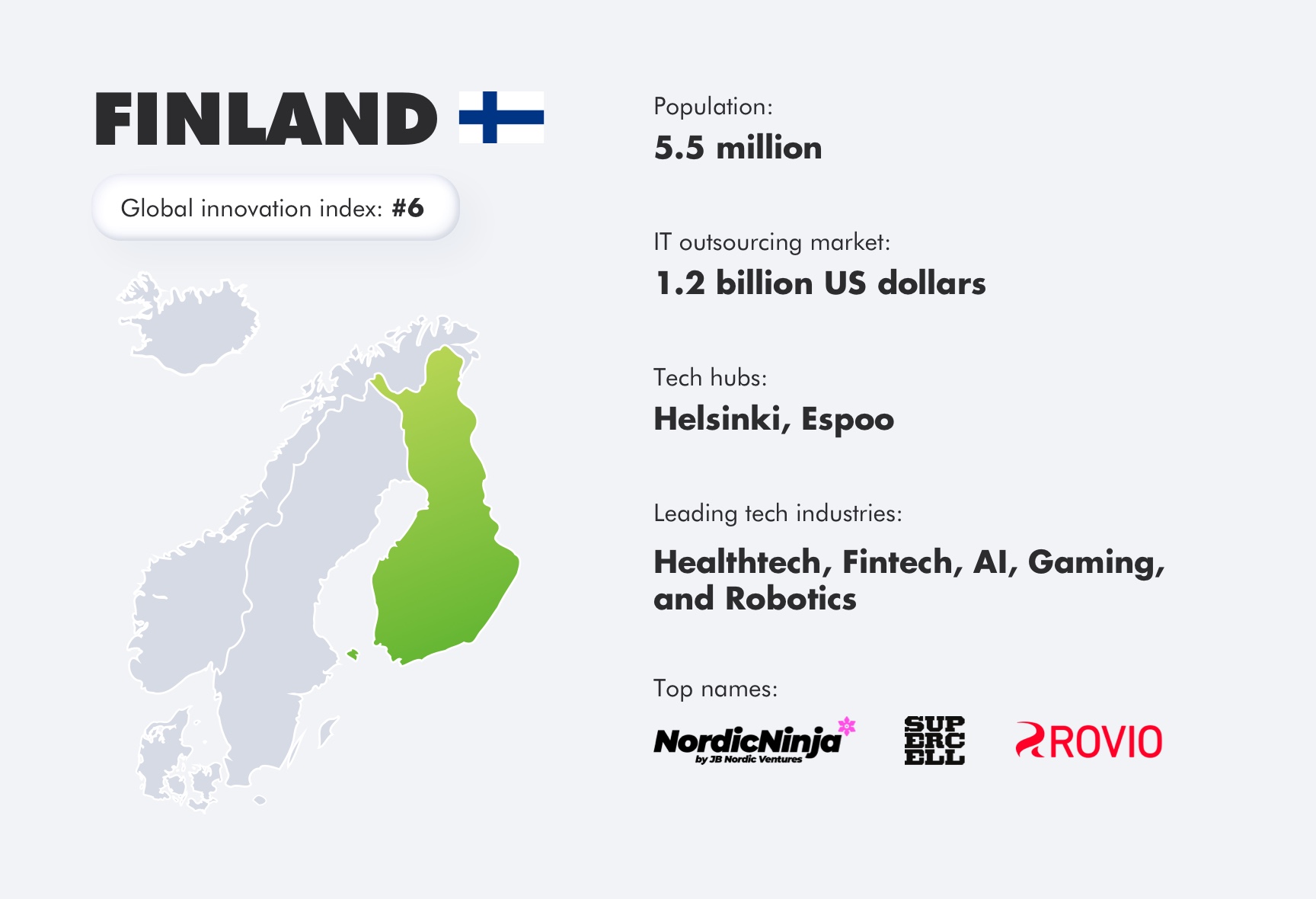

Finland

Finland is a global gaming leader and a favorite destination of Japanese investors, with over 20 startups founded.

In 2021 Finland was ranked second in the European Union’s digital performance comparison. Its government is aimed to lead the way in technology, application development, and digital services and has already made rapid strides to digitize a broad range of government services.

Still, like many other industries, Finland’s IT sector was hit by the Covid-19 pandemic which resulted in the fall-off in orders and lay-off procedures reported by technology companies. However, at the end of 2020, the emerging signs of recovery throughout the IT sector appeared, and currently the main dilemma of IT businesses in Finland is the need for 130,000 new specialists over the next decade.

Norway

Norway is the richest country in the region mainly due to oil and gas reserves. But now, the Norwegian economy is going through diversification and the new industries, including IT, start to boom. It also ranks high among the best countries for business and has seen a significant inflow of venture capital recently. The most actively invested tech sectors included Software-as-a-Service (SaaS) and hardware companies addressing the climate, construction, and financial industries.

Like the other Nordic countries facing a skills shortage within the IT industry, Norway is not an exception. With at least 80,000 people working in the IT industry, there is already a shortage of 5,450 engineers and ICT workers. Almost 30% of the companies reported difficulties in hiring skilled IT labor that prevents them from further growth.

Iceland

Iceland is an island country with not only lots of spectacular volcanoes, geysers, and other natural beauties but also vivid startup life.

The government contributed to the establishment of several private funds to help seed and pre-seed startups grow, and universities are encouraging students to focus on science and technology-related subjects. The favorable areas within the tech industry in Iceland are Fintech Health and Biotech solutions, especially for the Maritime and Fishing industry.

So despite its small population and geographic remoteness, the tech industry in Iceland is actively developing and the need for IT talents is growing.

Tech Labor Shortage

Just like other developed economies, Nordic countries suffer from massive talent shortages. ICT architects, test analysts, ICT testers, software engineers, and developers are the most wanted specialists. UX, data analytics, cybersecurity, technical architecture, enterprise architecture, and DevOps are the areas that witness the most acute deficit.

When it comes to Nordic countries, Finland seems to have the biggest trouble finding tech skills. Sweden, Norway, and Iceland also face serious tech recruitment problems, as described above.

The lack of qualified specialists paired with the rapidly growing market makes Nordic companies seek professional assistance elsewhere. Many of them outsource tech processes to India or consider closer destinations like Central and Eastern Europe.

Developer Salaries

Apart from the labor shortage, high software development costs remain a powerful reason to outsource. Remote teams offer more affordable hourly rates than the Nordic tech market.

Moreover, with the transition to remote work, online cooperation became a norm. Hence, it doesn’t matter where the team resides as long as it provides quality services. To feel the difference between developer rates in outsourcing destinations, check out the salary overview for Nordic countries.

What to Expect in Upcoming Years

The global market and Nordic countries, in particular, will continue to invest in software solutions facilitating digital transformation. 76% of executives сlaim to be actively innovating their businesses to keep them running. It translates into the increasing need for quality tech support and, hence, makes more companies outsource.

In the upcoming years, cloud adoption and intelligent automation will dominate the outsourcing needs of Nordic companies. More than half of Norwegian organizations will run 70% of their new applications in the cloud. Cloud adoption is also high in Sweden (34%), Denmark (34%), and Finland (37%). Actually, 91% of companies voiced the need to improve cloud management and integration governance capabilities. As to the intelligent automation growth, the figures are also promising. 44% of companies plan to increase the use of intelligent automation and 30% are going to adopt it in the future.

Novel technologies, including AI, IoT, machine learning, and Blockchain also become strong in the Nordic. After the whooping growth of AI (65%) and IoT (68%), software vendors implement more and more innovations. Therefore, the listed trends are sure to affect the Nordic labor market needs and outsourced services for several years.

| Sweden | Denmark | Finland | Norway | Iceland | |

|---|---|---|---|---|---|

| Junior | 3500-5000 | 4500-5000 | 3100-4500 | 4000-5100 | 5400-5800 |

| Middle | 5000-7000 | 4900-6500 | 4500-5300 | 5100-7000 | 5800-6600 |

| Senior | 5800-8000 | 5500-8900 | 5300-7000 | 7000-8500 | 6600-8000 |

Why Nordic Companies Choose Leobit

Leobit is a Ukrainian full-cycle web and mobile application development provider for technology companies and startups. Businesses from the Nordic region have chosen our engineering services for years. The outdoor and indoor cycling solution for our Norwegian partner is among the projects we are proud of. Leobit is also a member of the Norwegian-Ukrainian Сhamber of Сommerce, which allows us to provide better services to our Nordic customers.

Enjoy a remote team working with no time difference within close proximity. We hire specialists skilled in leading technologies and domains, 30% of which have senior-level experience. Our team has a business level of English proficiency, so the communication will be smooth and convenient.

Learn more about our services here or contact us to discuss your project.