The accelerated pace of digital transformation is pushing many businesses to adopt fintech solutions. Advanced online banking systems, wealth management services, digital loans, fintech mobile apps, and other fintech startups are gaining traction. In 2020, despite the overall economic downturn, positive fintech growth tendencies remain in place. The trends for the upcoming years are also promising. By 2025, the global financial technology market is expected to gradually reach a worth of $305 billion. Year by year, financial services become more digitized and automate many manual processes with software.

This results in the growing demand for fintech startups that can supply financial organizations with reliable and secure fintech apps. This also increases the role of outsourcing software development as an alternative to scarce local markets that cannot provide the necessary workforce.

Want to know what fintech startups run the financial services industry in 2021? Get detailed insight into top fintech startups, in our article about:

- Top fintech startups in 2021: industry, location, and what they do

- App development outsourcing for financial technology companies

Top Fintech Startups in 2021: Industry, Location, and What They Do

In this overview of top fintech startups, we have relied on the annual list of 50 fintech companies compiled by Forbes and our independent research. These most promising fintech startups became distinctive last year and will continue to attract the attention of financial services and investors in 2021. The number of first-timers and financial technology startups that are worth now $2 billion, on this list is unprecedented.

Here are some of the budding stars that will reshape fintech software development in 2021. Watch these top fintech companies in 2021 to get inspiration for your project or learn what is happening with startups in fintech.

Chime

Industry

Location

San Francisco, CA, US

Services

This fintech startup is a neobank company that unlike traditional banks, doesn’t have physical branches and charges no monthly or overdraft fees. All the services are provided through the website or customer fintech apps available for iOS and Android users. The bank issues Visa debit cards without minimum balance, automatically rounds up purchases, supports early payments and a range of other fintech app features. Based on the latest evaluation, the worth of the fintech startup reaches $5.8 billion with around $808 million raised in Series A, B, C, D, and E funding rounds.

Check out Step-by-Step Guide: How To Hire Developers For Startups

Koyo

Industry

Personal loans

Location

London, the UK

Services

Koyo enables customers to take up to £5000 quick loans and pay them off within the next 36 months. The main target audience of this fintech solution is people suffering from temporary financial problems who need to find money as soon as possible. Koyo operates as a simple website with a loan calculator that shows the final rates, including Representative APR, total repayable, and total interest. Among other benefits, the fintech startup supports transactions with all the core British banks and doesn’t affect the credit score of lenders. It takes just 3 minutes to apply and 1 business day to find out the decision. Whereas end-users like this regulatory compliant shortcut to get a loan, investors bet on its profitability with $4.9 raised in the last debt and equity funding.

Brex

Industry

B2B lending and expense management

Location

San Francisco, CA, US

Services

Brex is a fintech startup launched for technology, e-commerce, and life science companies. This service provides entrepreneurs with corporate credit cards and the fintech solution for cash flow and expense management. By opening a Brex account, businesses can enjoy fast payment, free wire transfers, 10-20x higher limits, and all corporate transactions recorded in one place. It also supports the Rewards program that offers bonuses on rideshare, travel, recurring software, restaurants, and other services that are commonly used by startup employees. In May, the fintech startup with the current value of $2.6 billion raised another $150 million in series C funding. Brex is one of the financial services startups that focus on the B2B sector, which is less common than B2C financial services technology companies.

Lemonade

Industry

Insurance

Location

New York, NY, US

Services

Lemonade is one of the fintech firms that leverage AI, fintech apps, and chatbots to digitize insurance services. The fintech startup sells affordable insurance for homeowners, renters, and pet owners covering the main market needs. Users can get insured within 90 seconds and have their claim reviewed and paid in 3 minutes. Such a lighting speed has become possible thanks to artificial intelligence that handles user requests filed through the website or fintech mobile apps. The hallmark of Lemonade’s fintech app is the possibility to share the unclaimed money with any non-profit chosen. This company on our top fintech startups list is already bringing $115 million annual revenue with half a million customers.

Bambu

Industry

B2B wealth management

Location

Singapore

Services

It’s one of the rapidly growing financial technology companies that provide B2B tech solutions for financial institutions. The main target audience of this startup comprises banks, asset managers, digital disruptors, insurance companies, and digital banking. Bambu is a multipurpose SaaS solution for deploying Robo-advisors and building financial consulting tools. It enables financial organizations to use one of the white-label products to reduce the time of deployment, build fintech apps without coding, and optimize the software development process. Thus, fintech firms can go through the digital transformation more smoothly and quickly implement innovative solutions to please their customers. So far, B2B Robo-advisors have obtained $3.4 million of funding.

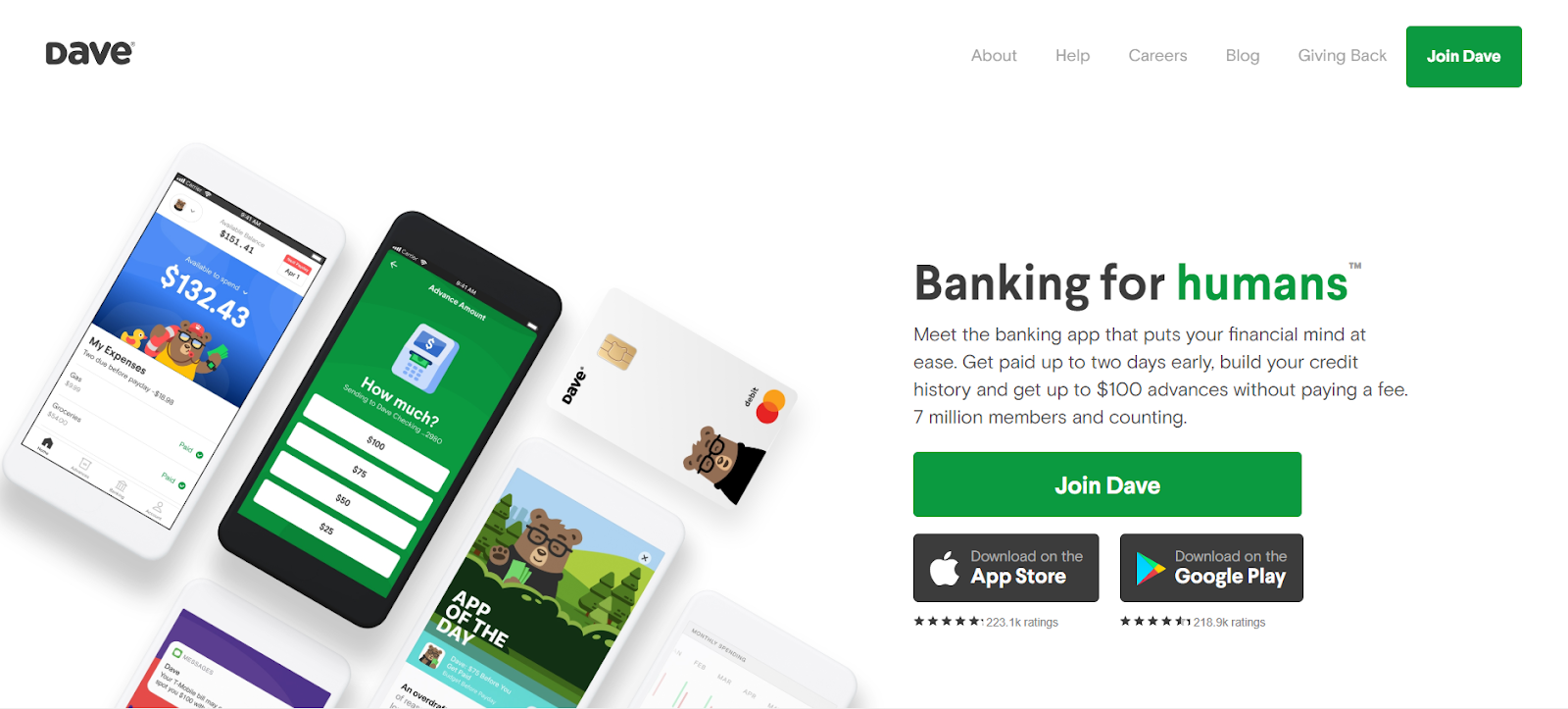

Dave

Industry

Personal finances

Location

Los Angeles, CA, US

Services

Dave is an online banking platform available to IOS and Android users as a fintech mobile app. The fintech startup has no minimum balance, overdraft, or ATM fees across the network of 32,000 MoneyPass ATMs. Every account is protected with top-notch banking security and up to $250,000 FDIC-insurance. Besides, thanks to the partnership with LevelCredit, Dave’s fintech mobile app allows customers to build up their credit score. You can join it for only $1/month, like 7 million users that have already done that. The current funding of Dave reaches $76 million, which is a pretty promising result for the fintech startup.

Pleo

Industry

B2B mobile payments

Location

Copenhagen, Denmark

Services

Pleo is another representative of B2B fintech companies on our list. It’s a business spending platform for all-size enterprises that want to provide their staff with smart company cards. Such an approach boosts team spirit by giving employees more freedom, simplifies corporate purchases, and enables businesses to optimize finance management. While users buy work-related things on-the-go and instantly report expenses, financial departments control the situation, set limits, and enjoy bank-level encryption security. The operation of Pleo relies on prepaid Mastercards and convenient IOS and Android fintech apps. In 2019, this fintech startup closed $56 million series B to get $78.8 million of investment in total.

Root Insurance

Industry

Auto insurance

Location

Columbus, OH, US

Services

This fintech startup offers a fintech mobile app that sets insurance rates based on monitoring 200+ driving variables. The better users drive, the more they save. All the insurance-related hassle is managed through the IOS or Android app, where drivers can file claims in just 3 minutes, manage their policy, utilize Roadside Assistance, participate in the referral program, and more. This turns the use of auto insurance services into a pleasant experience and brings the fintech startup $528 million investment. According to the latest estimate, the cost of Root Insurance exceeds $3.65 billion.

N26

Industry

Neobank

Location

Berlin, Germany

Services

This financial technology startup is a German fintech superstar with 5 million customers and $782.8 million of total funding. Launched back in 2013, N26 gained its popularity thanks to the absence of hidden fees and ease of use. N26 is a combination of a web solution for online banking and handy iOS and Android apps. Customers don’t need to go to physical bank branches since they can open and fully manage their bank accounts online. In 2016, N26 obtained a German banking license, which confirms the security of all financial operations it completes.

N26 provides financial services in 22 European countries plus the US and supports Google Pay and Apple Pay in most of them. The convenience of this solution and its market offer makes it one of the top fintech startups to watch in 2021.

Laka

Industry

Bicycle insurance

Location

London, the UK

Services

Laka is a financial services company that focuses solely on bicycle insurance. This solution aims to substitute a standard insurance approach when a person pays a fixed fee in advance with a community-based model. To join a peer-to-peer insurance plan, bicycle owners need to register in a web app and select the value of their bike. The insurance fee will depend on the cost of the bike and the cost of the claims made during a specific month. If nobody claims that month, users may pay nothing.

Laka changes the common idea of what fintech startups are in insurance and how they work. 80% of the charged money goes back into the collective, which gives customers advanced control over their insurance charges. Investors also seem to like Laka’s approach and have already allocated $9.4 million for this project.

TaxFix

Industry

Taxes

Location

Berlin, Germany

Services

Taxes are a real hassle. That’s why an app that serves as an automated tax filing and refunds platform definitely deserves to be among the best fintech startups.

TaxFix is an application that enables users to get done with their tax returns in 22 minutes. The German startup offers an application that doesn’t require any specific knowledge to reimburse taxes. After answering a range of simple questions, users will get the maximum tax refund they are entitled to.

Although TaxFix is currently available in Germany only, they will expand to Italy and France soon. This model has shown to be successful among users, with over 2 million app downloads and 3,300 daily tax declarations so far. Just less than a year ago, in April 2020, TaxFix raised a $65 million Series C funding round, so in the following years, we are very likely to continue witnessing its growth.

Sustainably

Industry

Open-banking charity

Location

London, the UK

Services

A mom and daughter who launched this fintech company believe that new fintech startups have the potential to change the world. Sustainably is an anonymous charity platform that allows users to engage in charity right from their smartphone. The solution is supported both on Android and iOS devices.

Sustainably provides users with two ways to contribute. They can either round up their payments to share the rest or make monthly payments. Users can choose one of the 38 charity programs they want to join.

Sustainably is already supported by top UK banks and is about to close the crowdfunding. So far, it has collected 745,000 donations and joined our list of fintech companies to watch in 2021.

Raisin

Industry

Saving and investments

Location

Berlin, Germany

Services

Raisin helps users build their financial future and calls itself the first and only pan-European deposit marketplace. They target a €15 trillion market with a web solution that offers customers an overview of the best savings products and rates. Thanks to this financial services company, users can have all available offers at their fingertips and monitor their current deposits. Raisin also secures deposits up to €100,000 and cooperates with banks to offer the most favorable interest rates.

In 2021, Raisin is likely to become one of the top financial technology companies and continue its market expansion. They have attracted over 315,000 customers, partner with 105 banks, and manage €29.5 billion assets invested by customers across 30+ countries.

Want to build a fintech app or have a fintech startup idea? Contact Leobit to discuss your needs.

App Development Outsourcing for Financial Technology Companies

Despite the clear benefits of fintech solutions both to fintech companies and consumers, 57% of financial institutions call the rapid technology advancement the greatest source of business disruption. Fintech companies continuously compete for a qualified workforce, which is quite limited and very expensive in the US and Western European markets. This strains their resources and complicates the launch of a successful fintech startup.

Under such circumstances, fintech firms should look beyond the local resources and consider hiring a remote app development company. Outsourcing web and mobile app development services have several significant advantages compared to in-house engineering:

- A remote app development company can either fully cover the software development for startup or back you up at any stage for extra scalability.

- Fintech software development companies already have the relevant experience since they’ve designed and launched hundreds of fintech products.

- Outsourcing fintech software development companies provide access to the international pool of developers and remote talents.

- Fintech software development companies offer several models of cooperation: dedicated team, time & material, and fixed price. Therefore, they can tailor web and mobile app development services to the needs of any customer.

- Cooperation with an outsourcing provider helps fintech firms avoid lengthy hiring and onboarding. Just decide how many tech experts are needed to complete your project and get the necessary specialists.

Leobit is a web and mobile app development company with a broad Microsoft, web, and mobile technology stack expertise committed to building secure and regulatory compliant software. Named Top Software Development Agency 2020 by DesignRush and TOP APAC Mobile application consulting company of 2020, Leobit has already delivered over 150 web & mobile apps and keeps working on new projects. We cooperate both with fintech startups that are just starting their way and fintech behemoths focused on innovations.