Proprietary Lending Platform

Legacy software modernization that helped our client become a Top Lender in 203(k) lending for sponsored originations

ABOUT the project

- Client:

- Mortgage Bank

- Location:

-

USA

|Texas

- Company Size:

- 200+ Employees

- Industry:

- Real Estate

- Solution:

- Web Application Development

Leobit developed several solutions with self-standing modules. The main ones are a central hub for mortgage brokers and lenders, a borrower portal, and a specialized solution for managing renovation loans and repair escrows.

The central hub offers a dynamic and responsive interface that allows users to monitor their entire loan pipeline in real time. The portal also includes built-in support for One-Time Close construction loans, which allows brokers to select builders, upload project documentation, and track progress through a dedicated workflow. Another part of the solution is designed with the borrower in mind. It’s a secure, mobile-friendly portal that keeps borrowers connected to their loan status and tasks.

As our engagement is ongoing, we continually experience highly successful outcomes. Leobit has delivered an outstanding quality of work, speed of implementation, and an unmatched dedication to and ownership of projects they are involved in. Our Leobit team continually exceeds expectations for on-time delivery and quality of work product. Leobit has continually shown a willingness to provide flexible coverage and team scalability, has continually staffed out project with outstanding talent, and continues to be a most valued partner as we continue to extend our platform.

CUSTOMER

Our customer is an American nationwide residential mortgage lender with almost three decades of history. They provide a wide range of financing solutions to mortgage professionals, including brokers, lenders, and credit unions. The company’s product suite includes both mainstream and niche loan programs, such as FHA, VA, USDA, Fannie Mae, and Freddie Mac options. They also offer specialty programs like One-Time Close construction loans, manufactured housing loans, and renovation financing.

BUSINESSCHALLENGE

The customer’s platform was built using AngularJS and .NET Framework, which became obsolete over time. This restricted the company’s ability to expand and also put sensitive information at risk. Another problem lied in overreliance on manual processes and costly third-party services for the company’s core workflows. To remain competitive and scalable, the company needed to modernize its platform, automate key processes, and eliminate vendor dependency. That’s where Leobit stepped in.

WhyLeobit

The customer was seeking a technology partner with deep expertise in .NET and Angular to support their modernization efforts. Leobit was initially engaged to perform a rapid upgrade from AngularJS to the latest version of Angular for one of the platform’s critical front-end applications. Impressed by the quality, speed, and professionalism of delivery, the client chose to expand the partnership. This led to a long-term collaboration covering end-to-end modernization of the platform’s front end, back end, and infrastructure on Microsoft Azure.

Project

in detail

The collaboration resulted in the delivery of 15 front-end applications and 40 back-end microservices. Our team led the back-end migration and modernized the front-end architecture across multiple applications. We also developed new front-end solutions, including broker- and borrower-facing portals and a mortgage rate comparison site.

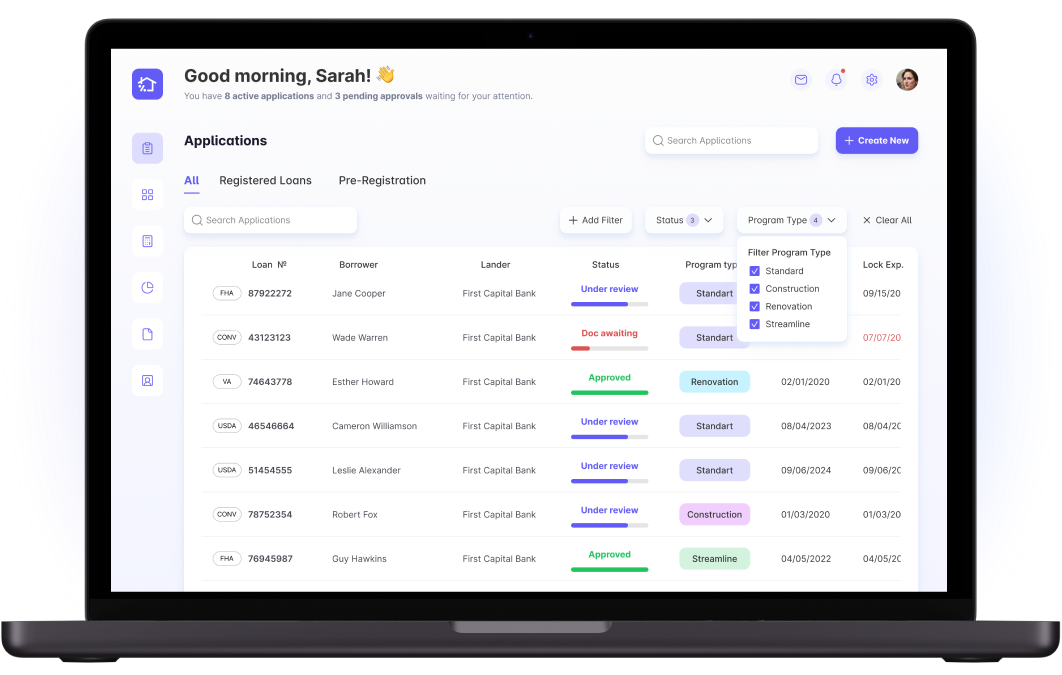

Broker-facing website modernization

The broker-facing website supports the full cycle of online mortgage application processing. Brokers can initiate loan registration, select loan programs (including CONV, FHA, VA, USDA), and submit applications directly through the platform. The system dynamically adapts subsequent form steps and validation rules based on user input and selected loan parameters, supporting over 50 loan statuses and various program types such as Standard, Construction, Renovation, and Streamline.

Our team migrated the front end from AngularJS to Angular 8. We refactored legacy components and implemented a modular architecture with reusable form logic, state management, and business rules abstraction. We also added new workflows for task notifications, which enabled brokers to assign and track borrower responsibilities in real time.

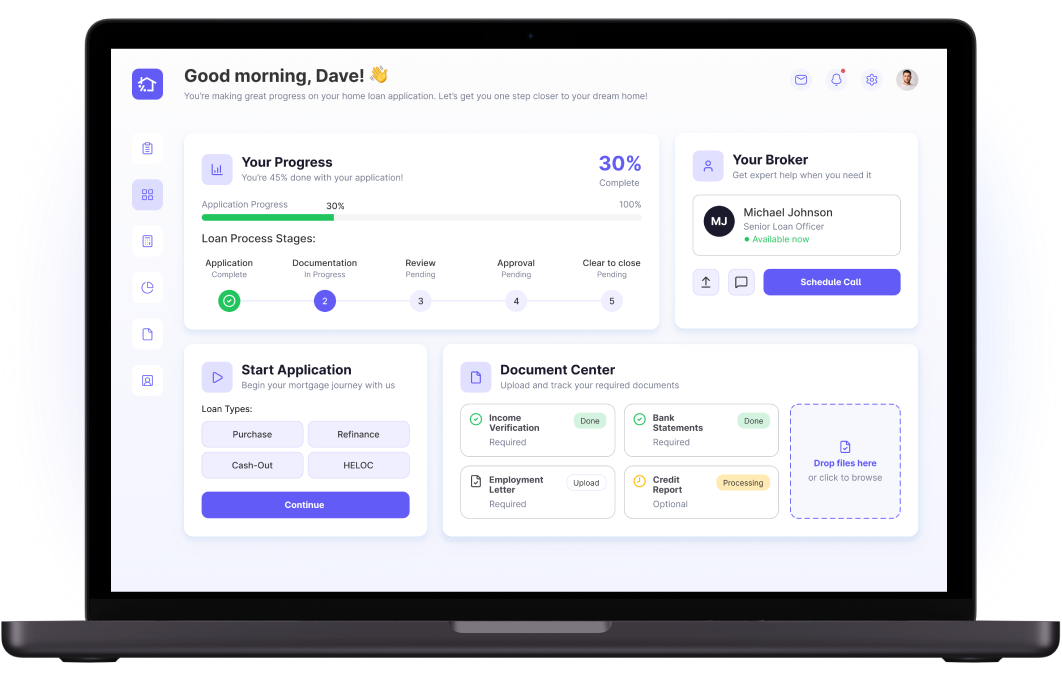

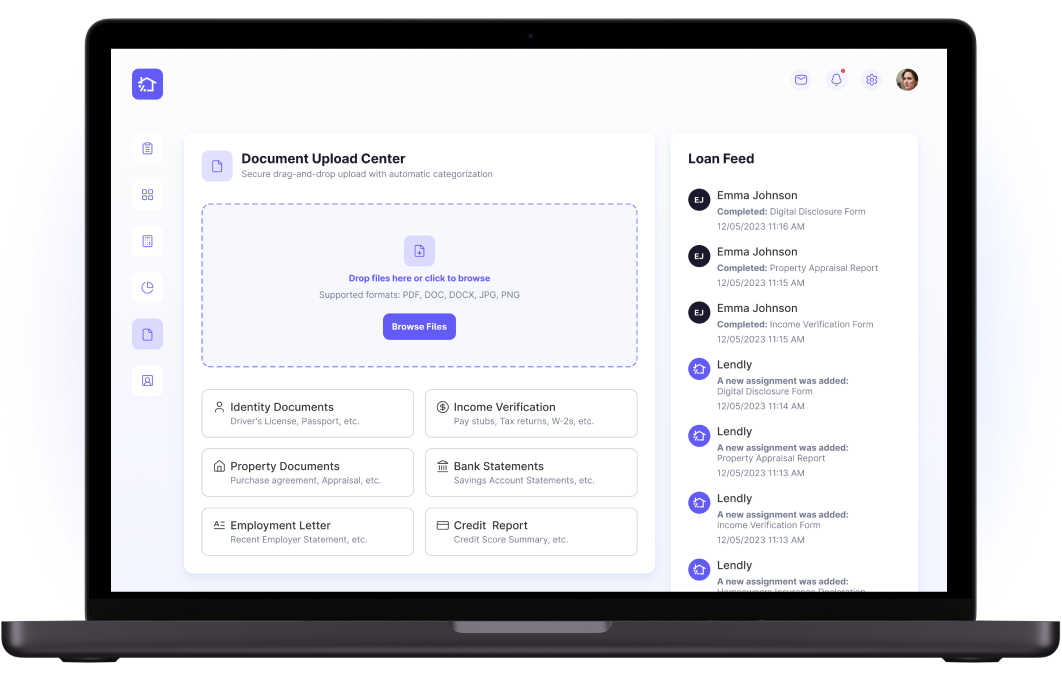

Borrower-facing website modernization

The borrower-facing website was similarly upgraded from AngularJS to Angular 8. This application allows borrowers to submit loan requests, upload supporting documents, and provide personal, employment, and financial information through guided multi-step forms.

Leobit implemented advanced form validation mechanisms, secure document upload flows, and real-time loan status tracking powered by SignalR for a dynamic user experience. The borrower portal also includes features for submitting eConsent, selecting loan types, and receiving automated notifications based on broker-assigned tasks.

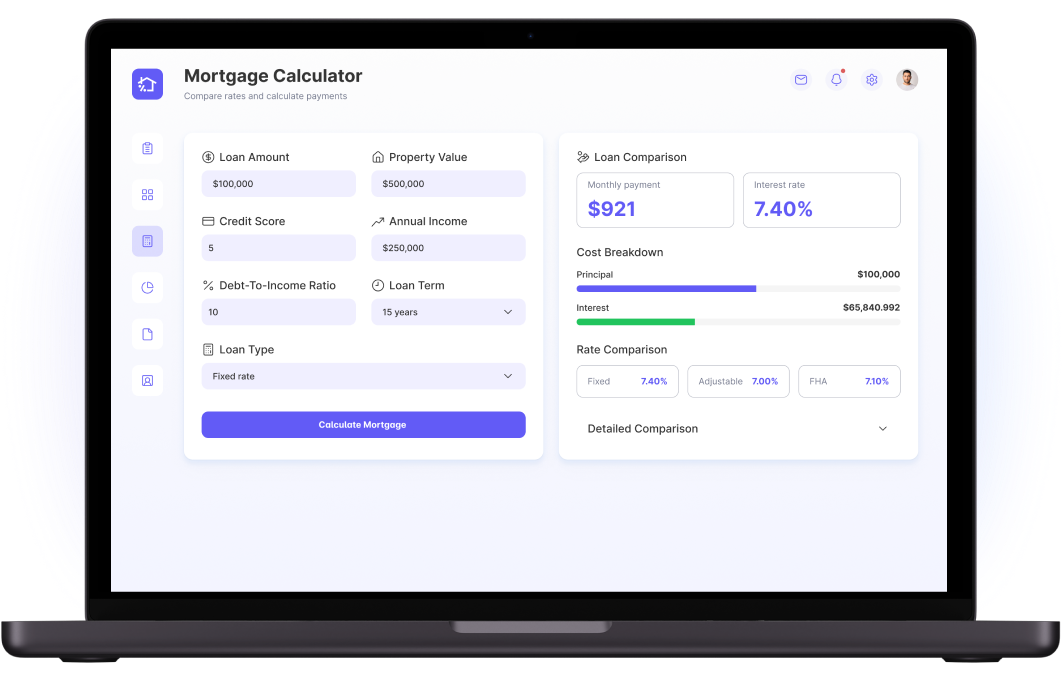

The mortgage rate comparison website redesign

Leobit redesigned and modernized the client’s mortgage rate comparison website, which enables users to generate real-time loan estimates based on personalized financial data. The original application, built on AngularJS, was fully reengineered and migrated to Angular 8 to improve performance, maintainability, and user experience. Our team adopted a component-based architecture and introduced a centralized state management system using RxJS.

At the core of the application is a custom-built mortgage calculator engine that processes inputs such as loan amount, property value, credit score, income, and debt-to-income ratio. The calculator dynamically fetches rate data and loan program parameters from the back end and Azure SQL Database, and generates side-by-side comparisons of available mortgage options (e.g., fixed vs. adjustable rates, FHA vs. CONV loans).

To ensure high performance and data accuracy, we implemented debounced form input handling, client-side validation, and API throttling for real-time requests. The calculator also integrates with the customer’s Mortgage Pricing Engine to reflect the latest rates, overlays, and eligibility rules in real time.

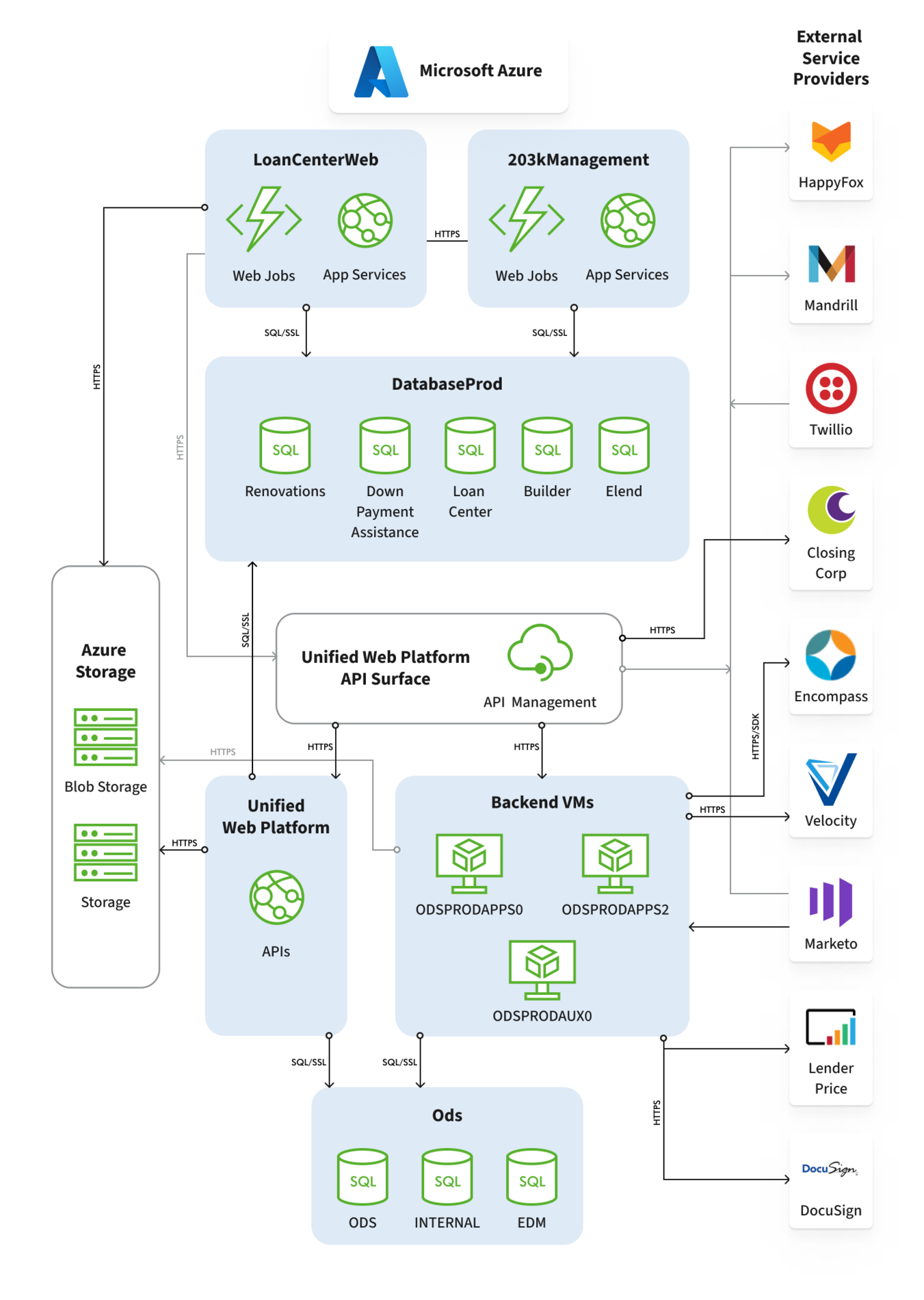

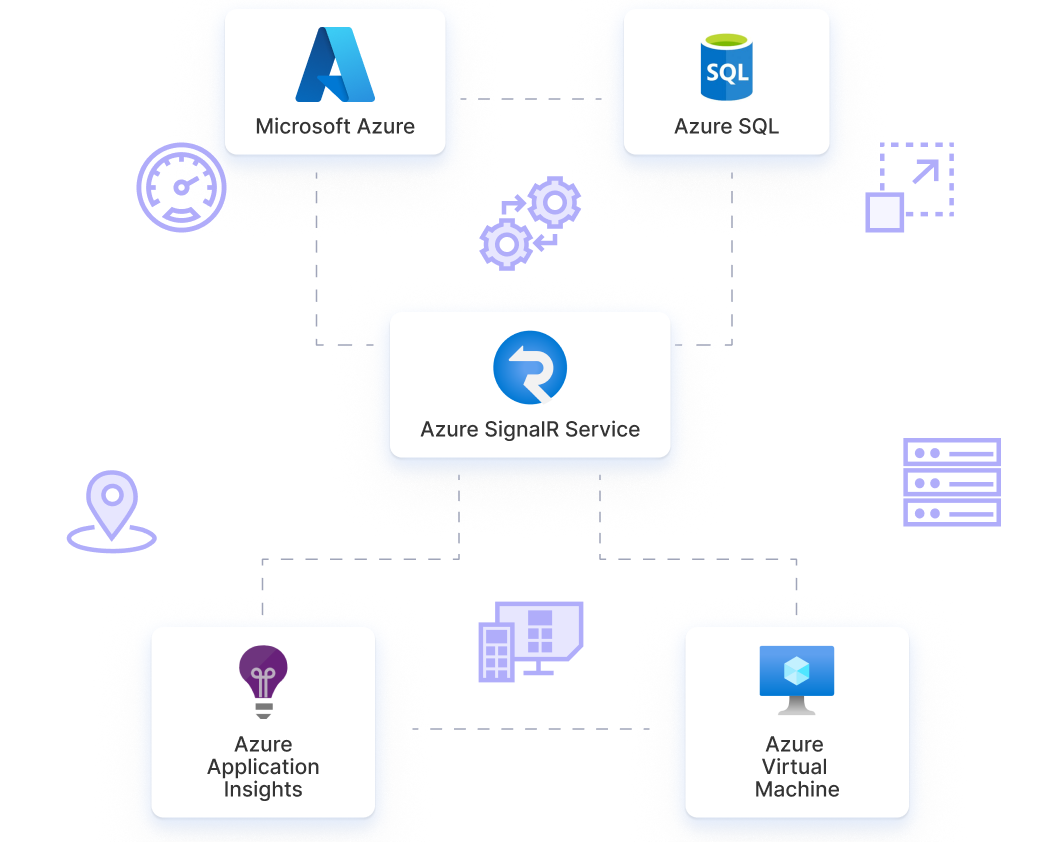

Azure-first infrastructure

The customer’s platform was originally built on Microsoft Azure, but to meet the evolving demands of performance, scalability, and maintainability, it required significant architectural enhancements. Leobit modernized the system by using a broad set of Microsoft Azure technologies within an Azure-first infrastructure approach.

We used Azure SQL Database to ensure reliable, high-performance relational data storage with intelligent autoscaling, geo-replication, and automated backup and restore. To enable real-time data interactions, such as instant form validation, loan status updates, and broker notifications, we integrated Azure SignalR Service. Azure Functions power many serverless, event-driven processes, including back-end triggers, automated workflows, and document processing, significantly reducing infrastructure overhead.

For monitoring and diagnostics, our team embedded Azure Application Insights across services to provide real-time visibility into application health and performance metrics. And to ensure continuity during the migration phase, we supported legacy components and testing environments through Azure Virtual Machines.

Secure data handling

Sensitive documents and assets are securely stored using Azure Blob Storage, with encryption and lifecycle management in place. To protect sensitive data and ensure compliance, Leobit implemented Azure Key Vault for secure secret, key, and certificate management, and Azure Entra ID (formerly Azure Active Directory) for managing user identities, Single Sign-On (SSO), Multi-Factor Authentication (MFA), and Conditional Access policies.

We used Azure AD Privileged Identity Management (PIM) to enforce least-privilege access principles, allowing secure role elevation only when necessary. To manage asynchronous communication and ensure loosely coupled service integrations, our team introduced Azure Service Bus and Azure Event Grid.

To ensure continuity during the migration phase, we supported egacy components and testing environments through Azure Virtual Machines. We also used Azure Blueprints to provid governance and configuration standardization across environments.

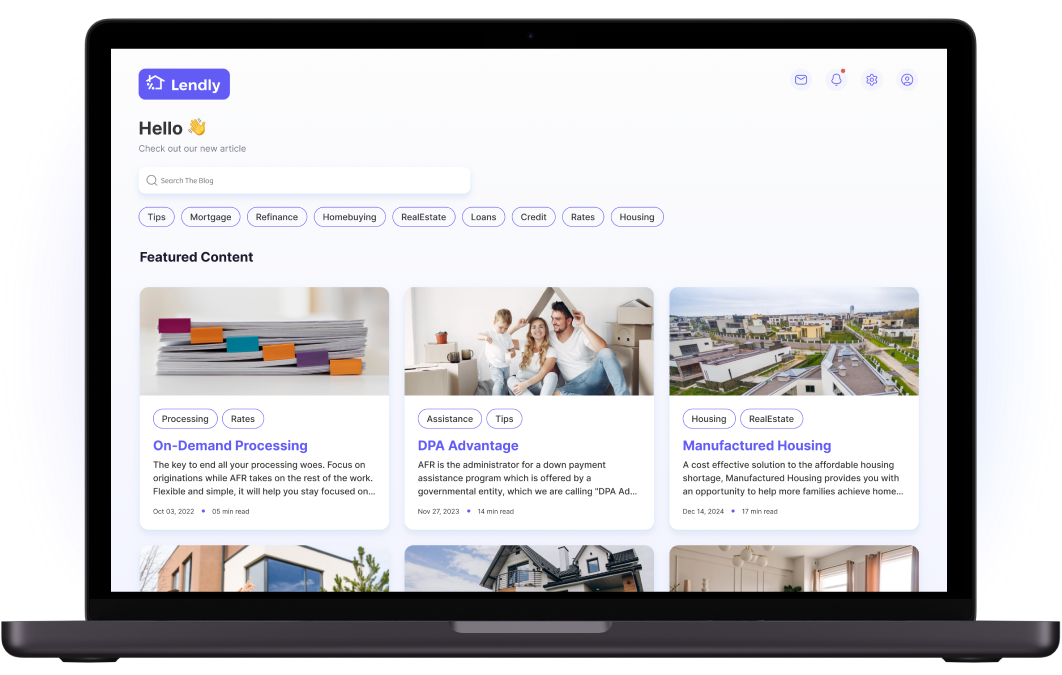

Custom-built educational portal CMS

To address the complex and dynamic educational needs of brokers and lenders, Leobit developed a custom content management system (CMS) from the ground up. This bespoke platform powers a centralized hub for mortgage professionals to access the latest industry updates, loan program guidelines, overlays, delivery options, and essential forms.

We used Angular for the front end and .NET Core for the back end. The CMS supports real-time updates, dynamic cross-linking between related content, and personalized content delivery based on broker type or delivery channel. Unlike off-the-shelf CMS solutions, which failed to support the company’s interconnected mortgage guidance structure, the custom solution provides the flexibility and performance needed to serve a broad and evolving user base. The result is a significant reduction in onboarding time and support inquiries, as well as a more intuitive and informative experience for brokers engaging with the company’s educational content.

Self-Service TPO Portal Transformation

The customer previously relied on a Third-Party Originator (TPO) platform and required brokers to submit PDFs, which the company’s staff manually processed. Leobit replaced this workflow with dynamic, automated web forms hosted in Azure and integrated with internal systems. This new centralized platform significantly simplified how brokers interact with the company. It offers them access to instant loan registration, real-time condition tracking, seamless document uploads, and direct messaging with the company’s staff.

Internal departments now receive structured data inputs and pre-filled 1003 forms ready for review, which significantly eliminates manual data entry and reduces processing time. As a result, brokers now experience a faster, more transparent, and more efficient workflow than what most competitors provide. These improvements have translated into tangible business outcomes: year-to-date, the company has funded 65.6% more loans, compared to the same period last year.

Technology Solutions

- Used Angular 8 to rebuilt the front end of multiple web applications for brokers, borrowers, and mortgage comparison.

- Migrated and modernized back-end services from .NET Framework to .NET 6 to improve performance, cross-platform support, and long-term maintainability.

- Used Azure Functions to enable serverless, event-driven workflows for form processing, notifications, and background job automation.

- Integration with Microsoft Azure Active Directory for user management and access control.

- Integration of Mortgage Pricing Engine for accurate mortgage pricing information presentation.

Valuedelivered

- Acquisition of the client’s company by a US-based and SEC-registered investment management company, founded by a Wall Street veteran.

- The US Department of Housing and Urban Development recognized our client as a Top Lender in 203(k) lending for sponsored originations.

- Thanks to automation, the customer managed to reduce human processing labor per funded loan by 28% in 2024, while simultaneously increasing throughput and enhancing service levels.

- Year-to-date, the company has funded over 14,000 loans, compared to 8,456 units during the same period last year—a 65.6% increase in funded volume, driven largely by improvements made to the platform and broker experience.

- In 2024, the company nearly quadrupled its Q1 loan origination volume year-over-year, with production in the wholesale channel alone increasing nearly 700%.