Cryptocurrency Payment Platform for Merchants

Custom software development for the U.S.-based fintech startup

ABOUT the project

- Client:

- FinTech startup

- Location:

-

USA

- Company Size:

- 20+ Employees

- Industry:

-

FinTech

- Solution:

- Custom Software Development

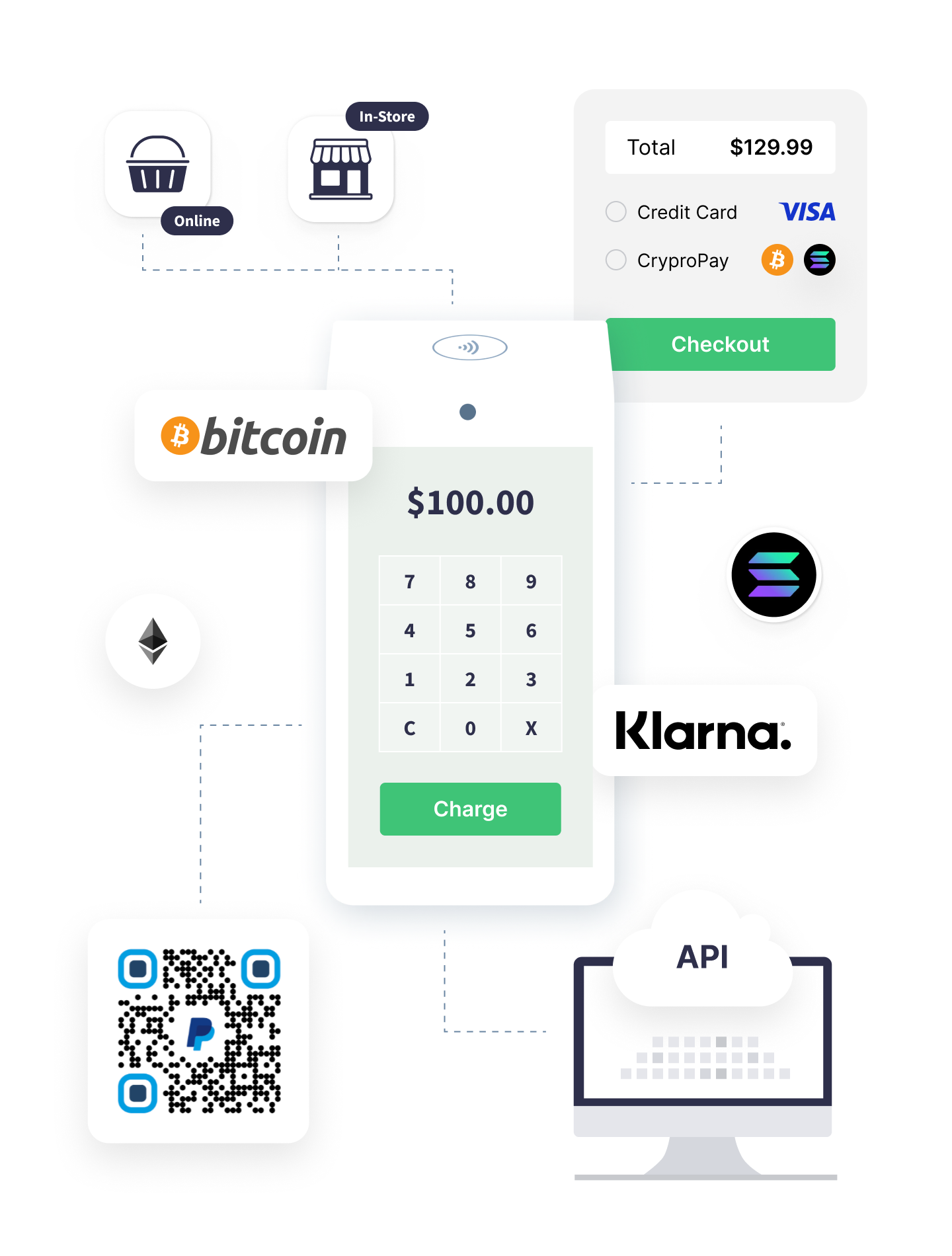

A cloud-based payment network for merchants that offers convenient integration with multiple crypto payment systems, digital wallets, and Buy Now, Pay Later (BNPL) solutions. It can serve both e-commerce and offline retailers, enabling them to accept cryptocurrency payments through a terminal that generates QR codes for varying cryptocurrency payment systems and wallets.

We’re really happy with how Leobit’s developers joined our team. They picked up the project quickly, demonstrated professionalism, and were always ready to take initiative and responsibility!

Customer

The customer is a U.S.-based fintech startup offering a platform that enables crypto payments for online and offline merchants. The company has launched an early version of its solution and is continuously enhancing it with new features while developing a more efficient and flexible architecture.

Business Challenge

The customer had been operating the platform for a while and already had a team working on improving its functionality. However, due to some project misalignments, they decided to replace that team. As they began assembling a new one, they needed to hire strong full-stack development specialists.

Why Leobit

Leobit provided experienced full-stack developers skilled in .NET, which is the main back-end technology behind the customer’s solution. Moreover, the customer was attracted by our engineers’ solid fintech expertise.

Project

in detail

Our specialists joined the project as part of a new team that replaced the customer’s previous one.

At first, we had to spend some time analyzing the solution and its existing architecture. Our specialists were given significant autonomy in decision-making. We were tasked with implementing several architectural features and handled most of their planning independently.

We developed several features and custom APIs on demand to help the customer onboard new merchants on their platform. We also started working on optimizing the solution’s onboarding workflows.

The Leobit team constantly works on new functionality to enhance the customer’s platform. One of our biggest tasks involves building a batch settlement logic for payments. We also constantly integrate the solution with new third-party services to ensure its connectivity with new partners.

New Client Onboarding Workflow

The solution involved a lengthy onboarding process for merchants, with multiple manual steps and intermediaries. We improved this workflow and continue working on its further automation. The current process is as follows:

- The client submits an application to join the platform.

- Our team reviews and approves the application, after which the merchant signs the required agreements via DocuSign.

- The application then moves down the pipeline, where Sardine runs an automated background check to verify the client’s information.

- and ensure the request is not fraudulent.

- Once verification is complete, we create a virtual account with a sponsoring bank, officially onboarding the client.

- We connect the bank account to crypto wallets and payment providers according to the client’s specific needs.

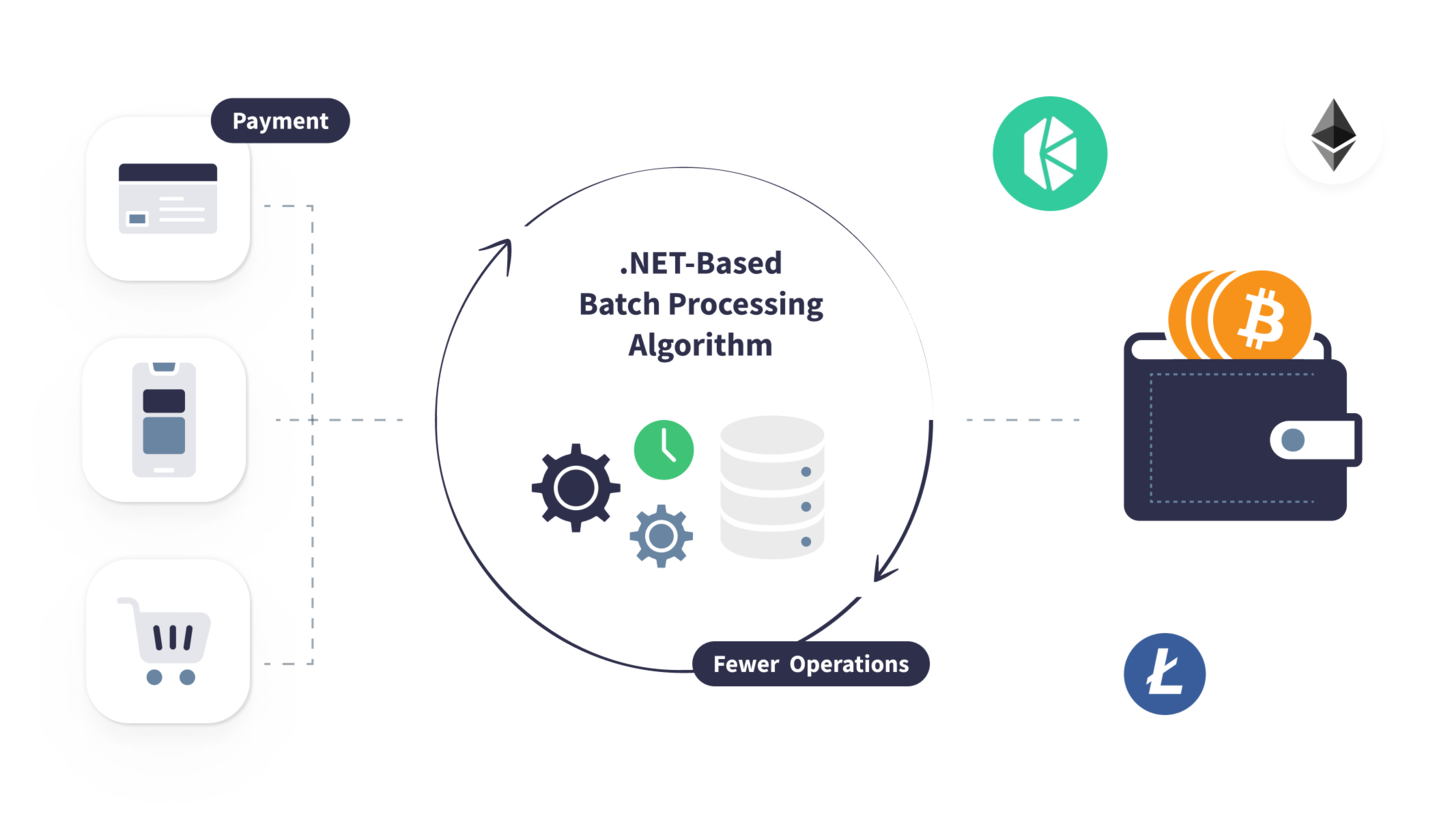

Batch Settlement Logic for Payments

A custom .NET algorithm collects multiple individual payment transactions over a day. It converts and processes them together as a single group (batch). The entire batch is automatically delivered to the merchant’s bank account on a daily basis via an Automated Clearing House or a wire transfer. The batch logic offers several advantages, such as fewer settlement operations, which in turn reduce processing costs and decrease real-time loads on payment gateways.

APIs for an Admin Portal

The customer also developed a CMS that provides all merchants with a dashboard with statistics, information on payments, and analytics. Our specialists worked on several APIs connecting this CMS with other services within the system. As a result, the CMS seamlessly collects information from different payment processors and e-wallets to provide detailed insights on payments and balance dynamics.

Technology Solutions

- Strong connectivity of all services within the system with custom APIs.

- Automation for client onboarding workflows ensured by background .NET Hangfire jobs.

- Integration with multiple third-party platforms, such as Sardine for know your customer (KYC) workflows and DocuSign for signing digital documents.

- Transaction automation ensured with event-driven AWS Lambda features.

- Secure authentication and data encryption.

Value Delivered

- Necessary expertise in .NET and custom API development.

- Seamless integration with multiple cryptocurrency payment systems and digital wallets within a single platform.

- Continuous optimization of the existing software architecture.

- Enhanced automation of payment and client onboarding workflows.

- Successful onboarding of several new merchants on the platform.