Multi-module payment processing ecosystem

Software Ecosystem for a Global Payment Processing Provider

ABOUT

the project

Client:

Location:

US

|California

Company Size:

Industry:

Solution:

Leobit helped a fast-growing California-based payment innovation company build multiple solutions for a multi-module fintech system. We developed a set of tools for payment processing and risk calculation of financial risks, which resulted in the system’s acquisition by a global payment processing provider

I’m immensely proud to be a part of this journey and look forward to continued success as we impact the FinTech sector together.

CUSTOMER

The customer is a rapidly developing fintech company aiming at the top spot in the domain of global payment processing. They provide security-centric integrated payment processing solutions for vertical-specific industries such as accounts receivable management (ARM), eCommerce, education, and healthcare.

Apart from processing payments, the customer handles multiple processes, such as interactions with various industry players and institutions and estimating risks associated with various merchants.

BUSINESS

CHALLENGE

Some challenges in the project emerged from the overall complexity of the customer’s business. The payments processing industry has a complex, rapidly changing ecosystem involving various institutions, technologies, and players.

For example, merchant payment transaction processing involves implementing anti-fraud measures, such as functionality for risk scorecard generation. The main challenge associated with creating this functionality was in different demands of regulators.

Besides, the customer needed solid automation for their business processes. The company heavily relied on spreadsheets manually entering data from third-party services, which required much time and effort. With the growth of customer’s business, spreadsheets had to be replaced for more efficient operations management and quicker data processing.

Why

Leobit

The customer chose Leobit as an ideal technology partner for the project due to our deep expertise in building secure and efficient fintech solutions. They admired our rich portfolio of successful finance-related projects, strong .NET expertise allowing us to gain status as one of the top .NET development companies globally according to Clutch. The customer was also attracted by our robust approach to security and readiness to dive into diverse regulations in order to deliver compliant solutions.

Project

in detail

Our team implemented numerous solutions for the customer, as new ideas and needs emerged. First, the client needed to automate some of their critical business processes in order to adjust them to the rapid business growth. Our BA specialist researched all the customer's requirements to come up with a clear vision for the potential project implementation.

Risk analysis system

We provided the customer with a web portal for risk analysis. The client can manually input the information on potential customers into the solution that uses analytical algorithms to assign these customers risk scores. The system substituted the customer's existing Excel solution, which lacked the flexibility and automation required to correspond to the customer's business growth. Our solution allows the customer to evaluate the risks of cooperating with various merchants and companies. The system is aimed at the customer's internal use only.

Mobile SDK for embedded devices

Our team developed an SDK (software development kit) for various scanning devices, such as terminals, engaged in the customer's operations. We closely worked with devices and applied mobile development technologies, such as iOS SDK, Swift, Ingenico RUA SDK, and Swift Package Manager, as well as embedded development best practices to create a set of tools for building and configuring mobile software for payment-related devices, primarily used for processing transactions. Our cooperation on this part of the project is ongoing as we help the customer implement new features and ensure new integrations for the devices.

Multiple modules for customer and payment management

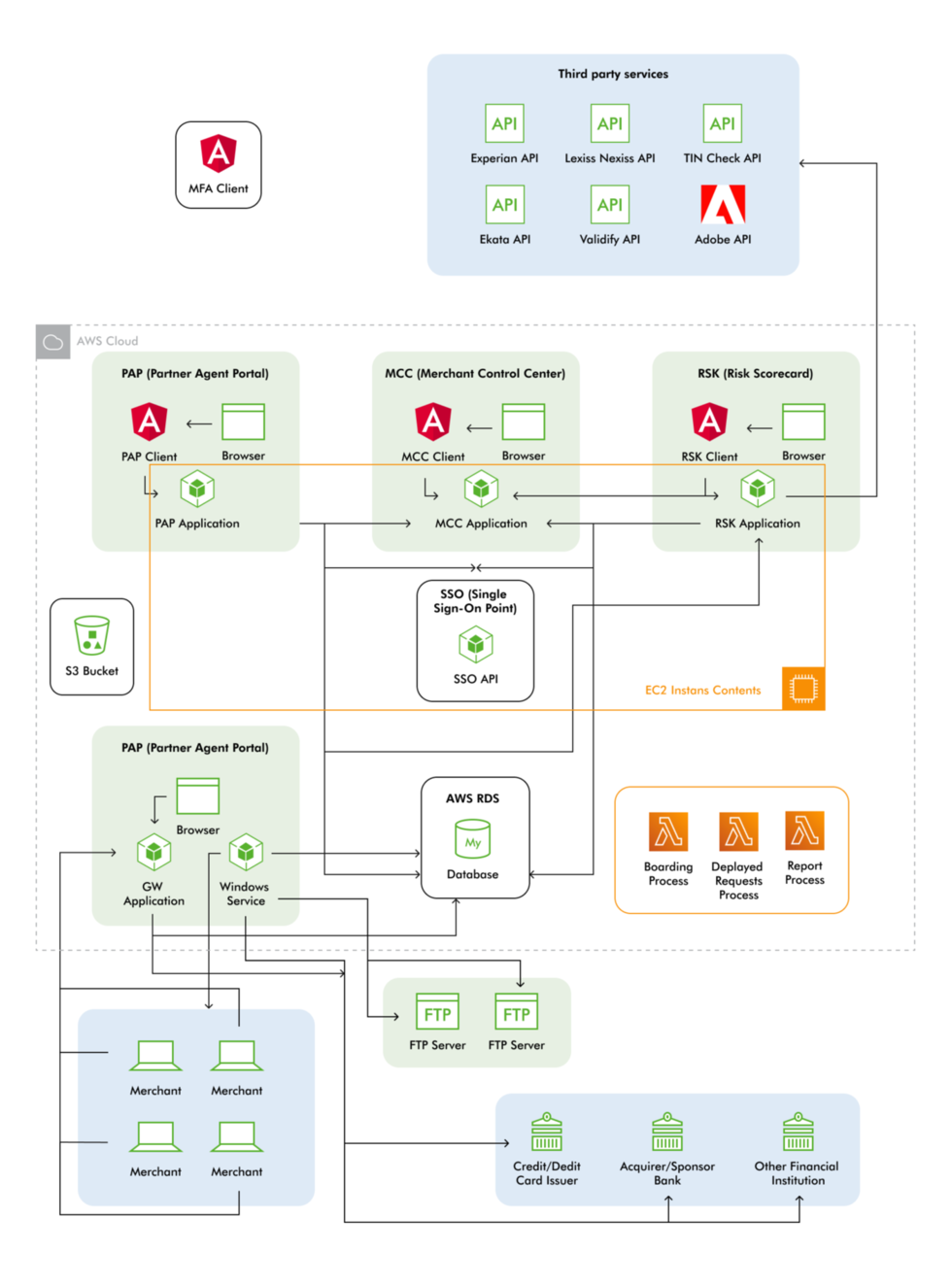

We built numerous modules for handling specific payments and transaction processing domains. This web system incorporates multiple modules, namely:

• Module I used for initiating the process of obtaining a merchant account;

• Module II aimed to support a contract lifecycle process for agents, starting from lead creation and ending the lead conversion into merchant accounts;

• Module III – a portal for merchants, agents, RM’s, support, and account staff used for reconciliation, reporting, and merchant maintenance;

• Module IV – an automated workflow system used in underwriting (approving or declining) a merchant account;

• Module V - a module used to securely authenticate to all the aforementioned modules with one set of credentials;

• A system/interface to process transactions via API or Off-Site Buy Page.

3rd-party integrations for the customer's web ecosystem

To speed the business process, minimize manual data entry, and enhance the solution’s functionality, Leobit experts implemented multiple integrations with different third-party API services. For example, integration with ValidiFI allows acquiring banks to check the credibility of their potential partners. Integration with TINCheck accelerates receiving the Tax Identification Number with other personal and income details of merchants to aid in an onboarding decision.

Integration with LexisNexis, a leading global provider of risk intelligence provides the customer’s product with business information and analytics for better, more impactful decisions. Experian’s fraud prevention software integrated into the solution helps to detect payment frauds, while identity verification third-party API identifies fraudulent user accounts.

Flexibility of the Cloud

To make the solution more manageable, scalable, and cost-efficient for the customer, we leveraged the power of the AWS cloud. The solution’s modules and supporting functionality were hosted on various AWS services.

In particular, the system relies on Amazon EC2, Amazon RDS, and S3 bucket as its crucial database services. We also applied Amazon Route53 as a DNS service, Amazon Elastic Load Balancer, Amazon VPC, and Amazon Lambda Functions for serverless computing. A multi-module cloud architecture perfectly fits the system’s ongoing growth providing the customer with fast and simple scale-ups and upgrades.

The Journey

Behind Client's Success

years of successful cooperation

people in the team

Technology Solutions

-

Functionality for accepting, processing, and settling payments for merchants in vertical-specific industries

-

Automated risk analysis system to clearly and accurately evaluate how risky a merchant would be to acquire

-

Versatile environment for underwriters to easily assess recommendations and determine the creditworthiness of merchants, agents, ISOs

-

Receiving accurate results for a set of checks from 3d parties vendors due to multiple integrations

Value

delivered

-

The system we developed was acquired by a global payment processing provider, and Leobit continues expanding the solution.

-

100% of the customer’s payment workflows that have previously been done manually are now automated.

-

Leobit eliminated inevitable human errors, saved customer’s costs for manual work, and, most importantly, decreased the time of deals processing by five times.

-

The customer received a simplified merchant onboarding process.

-

The customer is not just using a solution to process their end-users but also selling it as a SaaS.